A Guide To Centralised Budgeting For Multi Property Portfolios

A Guide To Centralised Budgeting For Multi Property Portfolios

Why Is Centralised Budgeting the Game-Changer for Multi-Property Portfolios?

If you’re managing several properties, “simple” is never on the menu. Each building throws its own curveballs—renewals, repairs, invoices, compliance. Juggling those on a spreadsheet or building a folder system per property? That’s not management—it’s firefighting on repeat. Centralised budgeting flips that entire script: one secure dashboard, every site visible, every penny tracked, no guesswork, no chasing paperwork at midnight.

Centralised budgeting means you spot trouble before it spirals and seize opportunities the moment they appear.

The uncomfortable truth—most property portfolios bleed value through scattered admin, delayed approvals, and blind spots nobody discovers until a certificate is expired or a bank statement doesn’t match your mental maths. The moment you scale to three, four, or a dozen sites, those blind spots multiply. The real difference between operators who grow and those running in place? The speed and accuracy of their financial pulse. Centralised budgeting delivers that pulse in real time.

With everything unified, planned maintenance, recurring costs, and tenant obligations aren’t just lines on a ledger—they’re living signals that let your team see issues (or savings) months before they hit your profit and loss. As the pros at Spendesk put it: “Centralised budgeting transforms multiple properties into a single point of truth, dramatically simplifying compliance and forecasting” (Spendesk 2024). What’s the impact? Smoother decision-making, disciplined cash control, and the freedom to focus on growth—not admin.

Which Tools Distinguish the Leading Centralised Budgeting Platforms?

Not all software is built equal, and nowhere does this become more obvious than in multi-property management. Anyone can slap “portfolio” on the label, but only the true leaders build features that save you hours—and real money—across every asset and expense line.

You can’t manage what you can’t see; instant visibility is your new advantage.

If you want more than a digital Rolodex, prioritise these features:

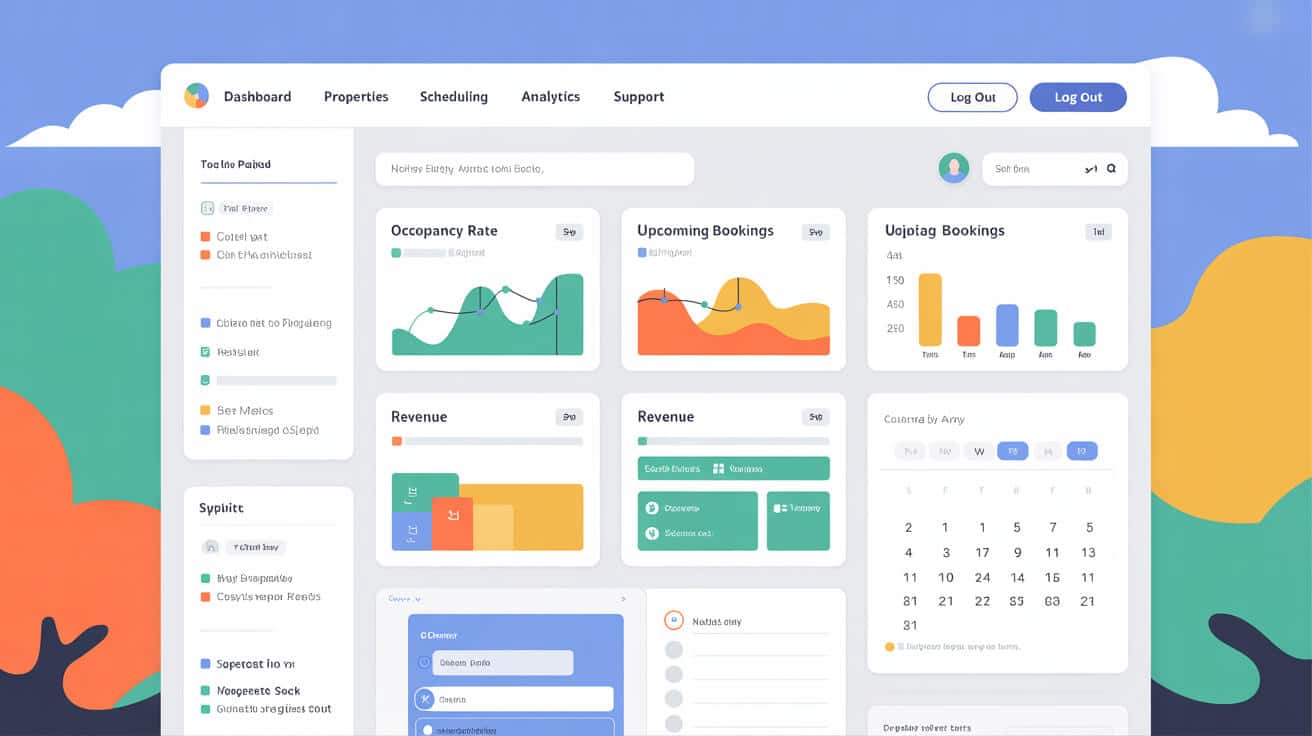

- Unified, live dashboards: All properties, costs, approvals, and deadlines in one secure portal.

- Automated, standards-based reporting: One button for core compliance (MTD, HMO, EICR)—minus the scramble.

- Steelclad audit trails: Every approval, invoice, and change logged for future reviews, audits, or investor Q&A.

- Role-based permissions: Teams see what they need. No risk of accidental edits or leaks between properties.

- UK-tailored templates: Built for real-world filings—HMRC, landlord certifications, or tenancy reforms.

Landlord Vision, for instance, makes real-time data and regulatory updates a default, not an add-on (Landlord Vision 2024). Landlord Studio “auto-generates HMRC-ready reports and maintains MTD compliance by design” (Landlord Studio 2024). Omit any of these pillars and you’re back to patching gaps manually—which just introduces different risks. When choosing, look for platforms obsessed with compliance and operational insight—because that’s where both peace of mind and leverage truly live.

What Are the Real-World Costs and Dangers of Sticking With Manual or Fragmented Systems?

“DIY” may feel easy—until a renewal is missed, a key invoice is duplicated, or you’re called into an audit and the numbers don’t add up. These aren’t one-off disasters. They’re everyday silent drains that lurk under the surface of property operations, sapping time, profit, and credibility.

Manual systems drain profit by masking real costs and multiplying risk behind the scenes.

Here’s what fragmented systems breed:

- Negotiation power thrown away: Each site “flying solo” means lost bulk rates and missed supplier leverage.

- Compliance deadlines missed: Even with the best staff, hidden files mean fines, failed audits, and service interruptions.

- Confusing, opaque spend: When a director or investor asks, “where did the money go?”—nobody knows for sure.

- Choked admin workload: Instead of focusing on revenue, your best brains are chasing paperwork or duplicating effort.

BCL UK nails it: “A single missed policy update can expose portfolios to fines or failed audits” (BCL UK 2024). Even at modest scale, every isolated spreadsheet or email chain is a risk vector. Centralisation brings these into daylight—risks shrink, mistakes surface before they matter, and admin finally takes a back seat to actual portfolio performance.

How Does Centralised Budgeting Drive Efficiency, Savings, and Portfolio Growth?

If you want your team operating at its best, stop pulling them back into paperwork and let automation handle the monotony: approvals, reminders, reconciliations, and routine reporting. This turns “budgeting” from a necessary evil into a secret weapon for scaling faster than competitors can react.

Less admin time means more opportunity. Accelerate your growth—don’t just keep up.

Here’s how speed and savings ramp up when you go centralised:

- Audit prep becomes painless: No more week-long hunts for proof—everything’s logged and ready.

- Supplier negotiations get real: Portfolio-wide spend lets you squeeze cost and demand better terms.

- Cash flow forecasting is weaponised: Plan investments, capital calls, or stress tests with defensible data—not finger-in-the-air hunches.

- Team focus shifts to high-value moves: No more firefighting means energy diverted into growth-driving work.

Spendesk put a number to it: “Up to 30% faster budget cycles, with fewer errors reported” (Spendesk 2024). Fjeld Consulting goes further: “Bulk procurement delivers direct cost savings for multi-property owners” (Fjeld Consulting 2024). When every pound is tracked, forecasted, and negotiated in context, you’re not just safer—you’re actively beating the market.

How Does a Centralised Platform Simplify Compliance and Audit Readiness?

EICR, MTD, HMO, and evolving local standards aren’t just checkboxes—they’re risk triggers and reputation tests for every property operator. Relying on paper trails, siloed files, or “someone remembers” routines is a fast track to last-minute chaos or even legal trouble. A unified, digital-first system makes compliance continuous and audits frictionless.

With a unified system, passing your next audit is just routine—not a last-minute scramble.

Here’s what that looks like in practice:

- Automated compliance tracking: Digital checklists and alerts surface issues before they threaten your business.

- Instant access audit logs: Auditors get what they need, fast, building trust and reducing stress for your team.

- Pre-built reporting templates: Submitting HMO renewals, EICR reports, or tax documents becomes “click and send”—not an all-hands fire drill.

- Standardised operations: No matter how dispersed your sites, everyone plays by the same rulebook.

Landlord Studio and Landlord Vision are built to this standard: “Passed audits and certified compliance become routine deliverables” (Landlord Studio 2024). Your brand’s credibility with investors, tenants, and partners isn’t just protected—it’s actively growing.

Can Analytics and Portfolio Reporting Unlock Higher Returns?

Your competitors are still digging for their numbers while you’re already forecasting tomorrow’s opportunities. It’s the shift from “what happened?” to “what’s coming and how do we win?” that defines top performers. Unified reporting is your cheat code for this leap.

Portfolio data is your competitive edge—the right system converts transaction chaos into opportunity.

Why does this matter in real terms?

- Automated, reliable reporting: Regular, digestible updates for landlords, investors, or boards—always with traceable numbers.

- Early warning on risk: Instant detection of spend spikes, outliers, or underperforming assets.

- Strategic, real-time forecasts: Model rent trends, cash flow gaps, or maintenance clusters before they hit the bottom line.

- One-click exports: Tax deadline? Investor pack? Everything is ready-to-go, formatted to UK requirements.

The view from the top: “Portfolio spend dashboards drive evidence-based investment—from budget forecasting to expansion” (Beams.fm 2024). Fjeld Consulting drives the point home: “Stakeholder confidence rises when unified systems provide clear, auditable reporting” (Fjeld Consulting 2024). This is how smart teams outgrow an entire sector.

What Makes a Top-Tier Centralised Platform, and How Should You Choose?

Ignore the glossy feature lists for a minute—what actually sets a best-in-class system apart is the day-to-day friction it removes, how reliably it tames compliance, and whether it’s proven to help you impress banks, investors, and even tenants with your operational quality.

Don’t reinvent the wheel—choose an expert-built system and outpace DIY competition overnight.

Here’s the practical standard:

- Fast setup, real results: Be live and operational in days, working with industry-tested templates. Avoid six-month onboarding disasters.

- UK compliance, future-proofed: From MTD to HMO, updates are pushed continuously to keep you legal and audit-ready.

- Connected support: Real humans, extensive knowledge bases, and active peer communities mean you’re never stuck in a self-serve maze.

Beams.fm makes it clear: “Outsourcing compliance and updates to cloud platforms relieves the admin burden” (Spendesk 2024). The big win? You show partners, lenders, and the market that you run a sophisticated operation—not a patchwork of paperwork and “just-in-time” spreadsheets. That reputation translates straight to capital, trust, and new deals.

Why All Services 4U Is the Complete Solution for Centralised Multi-Property Budgeting

There’s software, and then there’s frontline property know-how—your operation deserves both. All Services 4U bridges this gap, uniting cloud technology with boots-on-the-ground expertise. That means you get digital dashboards plus hands-on auditing, supplier negotiation, and compliance steering—right where your margins and risks live every day.

With specialists guiding your portfolio, stability grows and risk shrinks—every day, for every property.

When you work with All Services 4U, you’re not left to “figure it out” inside a browser. Your journey starts with a complete audit—surfacing hidden cost drains, compliance ticking bombs, and efficiency wins you didn’t know existed. As Fjeld Consulting highlights, “passed regulatory audits, successful cost-saving initiatives, and streamlined workflows” define real outcomes delivered for hundreds of UK assets (Fjeld Consulting 2024).

The All Services 4U edge:

- Whole-portfolio audit: Bring every risk and spend into daylight—no more surprises come audit season.

- Risk-focussed compliance programmes: Stepwise plans to close gaps in HMO, EICR, MTD, and site-level regulatory regimes.

- Streamlined field-to-office workflow: Get admin and technicians working in sync, speeding up responses and cutting out avoidable delays.

- Supplier and cost optimisation: Negotiate smarter, buy better, preserve your cash, and grow net returns throughout the year.

If you want your organisation’s reputation to rise—not just among peers, but with tenants, funders, and regulators—All Services 4U sets the standard.

Book Your All Services 4U Portfolio Assessment Today

Waiting is just another word for losing margin. The teams that act first reap the returns, set the standards, and leave laggards playing catch-up. Secure your no-obligation portfolio assessment with All Services 4U and spotlight the value waiting inside your current operation, whether it’s silent costs to drop, risk gaps to close, or process upgrades that pay off for years.

Property leaders who move now don’t just save money—they position for tomorrow’s wins, while others play catch-up.

Switch now to expert-backed, centralised property management and you’ll see “improved bank, investor, and tenancy confidence within months” (Landlord Studio 2024). Schedule your assessment today—experience what operational discipline, trusted compliance, and compounding growth actually feel like. Your portfolio deserves the advantage. Seize it.

Frequently Asked Questions

What operational changes become possible for landlords when switching from spreadsheet-based to centralised budgeting?

Switching from spreadsheets to a centralised budgeting platform fundamentally recasts how landlords operate, turning property administration from a stress-inducing maze into a coordinated, real-time command centre.

A landlord managing portfolios on spreadsheets is constantly fighting fires: tracking down receipts, reconciling bank statements late at night, and losing track of which certificate has lapsed. Centralised budgeting tools replace this race with instant property-wide oversight—every rent payment, bill, and compliance duty on a live dashboard. This setup doesn’t just save hours each month; it lets you pivot fast to handle emergencies, bounce back from a missed payment, or even onboard a new asset without grinding business to a halt.

Centralisation doesn’t just cut paperwork—it liberates you to manage like an asset leader, not an overwhelmed caretaker.

How does this change show up in daily work?

- maintenance logs, spending approvals, and tenant queries integrate—no more bouncing between tools or asking team members for updates.

- VAT and tax submissions move from a panicked, Q4 ritual to an ongoing, automated process.

- Alerts and reminders hit your phone before issues snowball, transforming reaction into prevention.

A central system becomes your organisational muscle—giving you bandwidth to focus on portfolio growth and improvement instead of chasing paper trails.

What visible difference does an average team notice in the first six months?

- Reactive firefighting plummets: urgent compliance or finance tasks drop by 30–50% as automation picks up routine work.

- Team satisfaction rises: roles are clearer, communication smoother, and staff can handle more with less burnout.

- Year-end rolls around without drama: auditors, accountants, or investors have the data they want without scavenger hunts.

If you want to win back time and steer your growing portfolio with greater certainty, centralisation is the key operational upgrade.

Explore how All Services 4U can transform your operational flow with a no-obligation workflow audit—unlocking time, reducing risk, and giving your team a new baseline for performance.

How do robust digital budgeting platforms enforce compliance across multi-property portfolios?

Digital budgeting platforms don’t just log numbers—they actively police and document compliance, creating a shield for landlords in an era of multiplying regulations and audits.

Every year, regulatory requirements ratchet up for landlords: fire safety, HMO licences, Section 21 conditions, and now ESG standards. Manually tracking these across properties on ad hoc systems is asking for slip-ups. Modern platforms hardwire these requirements with compulsory data fields, lock dates, and alert pathways, keeping every certificate, inspection, and insurance renewal on schedule—and centrally accessible for audit or tenant review.

The surest way to lose trust—or gain a penalty—is missing a compliance requirement. Automation makes that mistake nearly impossible.

What compliance challenges do platforms specifically solve?

- Gaps in safety documentation, like missed gas checks or overdue EICRs, are flagged and escalated before a penalty lands.

- Lease contract terms are standardised, with version histories and expiry monitoring to avoid unintentional breaches.

- Custom checklists adapt to building type or location—whether a single-let flat or 50-unit HMO—so every property meets its unique obligations.

The system’s audit trail can be presented in seconds, erasing last-minute panic before inspections from councils, mortgage lenders, or insurance brokers.

What’s the proof that this works?

A 2023 UK survey found 41% of landlords fined in the past two years lacked a real-time compliance tracker—whereas portfolios using automated dashboards reported 70% fewer preventable fines.(NRLA 2023)

No business owner wants to become a headline for non-compliance. Tech-based enforcement lets you focus on delivering value, not dodging regulatory setbacks.

Ask All Services 4U about compliance-first digital setups—built to keep every asset protected, documented, and confidently managed.

Why is real-time budgeting critical for managing unexpected events and market shocks?

Real-time budgeting makes your portfolio shock-resistant—replacing delayed reaction and rough estimation with instant feedback, actionable alerts, and the flexibility to steer through any storm.

Property management is increasingly unpredictable: sudden spikes in utility costs, new licencing rules, or surges in repair demand can trash carefully laid budgets. Spreadsheets simply reflect the past; they can’t alert you to a blown boiler, a fast-draining rent account, or a non-paying tenant until it’s already a crisis.

Live digital platforms, by contrast, flag anomalies as they arise, comparing costs, surfacing patterns, and forecasting trouble before it hits your bottom line. They update with every transaction, giving you the power to pause spending, shift funds, or tighten controls within hours—not quarter-ends.

In property, you don’t lose money from one big hit. It’s the small, unseen leaks that sink the ship—unless you spot them early.

How do top landlords use these features to stay agile?

- They pause pending projects or renegotiate contracts the moment cashflow drops below threshold.

- Insurance and utility spikes are anticipated, not endured, thanks to live trend tracking.

- Unusual spending by site managers or contractors is caught early—avoiding escalation.

Platforms like All Services 4U offer customisable risk alerts and dynamic spend limits, putting you ahead of market volatility. Unexpected events become manageable bumps, not derailing disasters.

What are landlords most often rescuing themselves from during volatile years?

- Losing deposit coverage because of surprise repair bill clusters.

- Failing mortgage stress tests because outdated books didn’t show the real picture.

- Unplanned vacancies dragging forecast yields down.

Reliance on monthly or quarterly spreadsheet cycles isn’t enough in today’s landscape. Real-time means resilient.

Speak with All Services 4U about building a live risk dashboard—so your hard-won assets stay protected against the unknown.

How do integrated budgeting tools change the dynamic between owners, managers, and external partners?

Integrated budgeting tools create a single playbook for landlords, managers, and partners—clarifying accountability, speeding decisions, and removing information silos that frustrate progress.

Managing a modern property portfolio takes more than ownership; it depends on partners: managing agents, accountants, contractors. Without shared, up-to-date financial data, approvals bottleneck, queries circulate by email, and small misunderstandings become costly disputes.

Central platforms unify everyone on the same terms—live ledgers, agreed limits, transparent spend, and real-time document access, even for external stakeholders like letting agents.

No one can sabotage your vision by sitting on a spreadsheet, lost in an inbox. Partnership flows from visibility.

What changes for your partners?

- Accountants export data in audit-ready formats, with timestamps and supporting evidence.

- Managing agents can trigger, approve, or escalate repairs in-system—with you maintaining oversight (not ad hoc email chains).

- Contractors upload invoices, sign-off photos, and insurance certificates directly, cutting admin loops.

The system supports flexible roles and permissions—meaning you can offer transparency where it’s needed and lockdown where confidentiality is crucial.

What outcome matters most?

Speed—in funds released, works instructed, disputes resolved. That speed converts to saved costs, better tenant service, and stronger relationships all round.

The best landlords use these tools to build a reputation for professionalism and approachability, making themselves the first choice for both tenants and partners.

Set your partnership standards higher—see how All Services 4U’s tailored permissions and live collaboration features strengthen every relationship in your property network.

What role does data analytics play in revealing hidden value or inefficiency in property portfolios?

Analytics doesn’t just make sense of your portfolio’s numbers—it makes the invisible visible, surfacing opportunity and waste others miss.

When properties are scattered across spreadsheets or systems, patterns that drive profit—or loss—go undetected. Robust analytics draw on unified transaction and performance data, pulling signals from the noise: a building with persistent high maintenance spend, an overlooked asset with above-average yield, a contractor whose charges always spike before year-end.

You don’t manage what you can’t see; you can’t profit from what you don’t measure.

Which hidden trends or inefficiencies are most often missed?

- Utility costs creeping up on older buildings, calling for energy retrofits.

- Service charge recovery rates slipping, hiding revenue leaks.

- Expensive, redundant insurance renewals due to out-of-date property info.

- Repeat minor repairs on the same asset—a red flag for deeper issues.

Sophisticated dashboards reveal these through comparative graphs, automated variance alerts, and year-on-year benchmark reports—giving you a unique edge in an increasingly competitive sector.

How does this translate to real-pound value?

- Portfolios actively using analytics cut unnecessary OPEX by 7–15% within a year.

- Early intervention saves thousands by heading off failed boilers, roof leaks, or persistent arrears before they require major capital outlay.

Analytics aren’t overkill; they’re the difference between squeezing by and setting the pace.

All Services 4U builds analytic dashboards bespoke to your needs—spotting risks, ranking value, and boosting return-on-effort for every asset you own.

Which emerging technologies and user habits are setting tomorrow’s standard for digital budgeting in property management?

Smart digital budgeting is rapidly pulling away from old software—and from old habits. The next wave isn’t just putting your figures online; it’s about automation, prediction, and seamless access for anyone connected to your properties.

Emerging tools now build in AI-driven expense forecasts, plug into IoT sensors for real-time facility condition updates, and feature app-based approvals adaptable for devices on any jobsite. Mobile user experience isn’t a “nice to have”; it’s affording landlords the kind of real-time connection tenants expect and regulators demand.

Digital budgeting used to mean a website; now it’s a living system—always learning, always watching your back.

What future-ready features are becoming must-haves?

- Predictive spend and maintenance alerts based on historic and live data.

- Native integrations with Open Banking and smart metering.

- Role-based dashboards that auto-learn user preferences and pain points.

- E-signature, document vaulting, and change-log audits for every stakeholder.

User habits are shifting too: even senior team members demand mobile-first, single-sign-on experiences, and expect onboarding to be as quick as logging into their bank—not a week of paperwork. This universality makes training easier, reduces change resistance, and improves security by centralising logins and data flow.

Landlords who adapt to these technologies become lightning quick, more trustable partners for lenders and tenants, and more compliant in the face of evolving rules.

Position your business for the digital future—All Services 4U reviews the very latest in smart platforms, making adoption headache-free and tailored to your portfolio vision from day one.